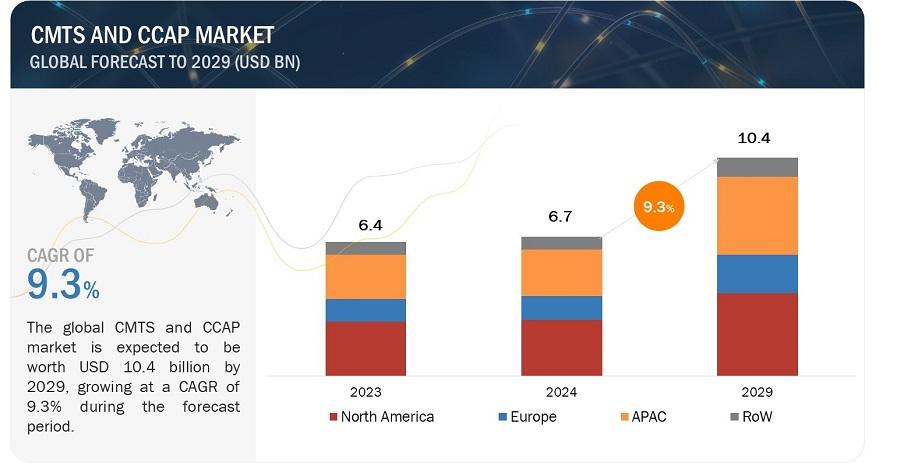

The cable modem termination system (CMTS) and converged cable access platform (CCAP) market is projected to grow from USD 6.7 billion in 2024 and is expected to reach USD 10.4 billion by 2029, growing at a CAGR of 9.3% from 2024 to 2029.

Increased investment in broadband services is one of the key driving factors for the market; compared to fiber optic networks upgrading existing cable networks with CMTS and CCAP is a more cost-effective solution for many service providers. This makes it an effective option for both established players and those expanding their service offerings in developing regions.

CCAP and CMTS systems with integrated edge computing capabilities can deliver a more responsive and seamless user experience and can prioritize and process critical data locally, optimizing bandwidth usage and ensuring a consistent and reliable user experience.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=120044037

Converged Cable Access Platform segment is expected to witness highest CAGR during the forecast period.

Due to the increasing integration of video and data services. CCAP enables the convergence of video and data services on a single platform. This integration streamlines network architecture, reduces operational complexity, and enhances the efficiency of delivering both video and broadband services over cable networks. The cable industry's move towards Distributed Access Architectures (DAA) involves distributing the traditionally centralized functions of the CMTS (Cable Modem Termination System) closer to end-users. CCAP facilitates this transition, improving network efficiency, scalability, and reducing latency.

Virtual CMTS in the CMTS market to witness highest CAGR during the forecast period.

The broader trend of network virtualization and the adoption of Software-defined Networking (SDN) principles have influenced the development and deployment of vCMTS. Virtualization allows for more flexibility, scalability, and efficient resource utilization. It enables cable operators to optimize network resources by running CMTS functions on standard commercial off-the-shelf (COTS) hardware. This can lead to cost savings in terms of capital expenses and operational expenses, as it eliminates the need for dedicated and proprietary hardware.

DOCSIS 3.1 Standard is expected to hold the largest market share in the CMTS and CCAP market by 2029.

DOCSIS 3.1 introduces improvements in spectral efficiency, allowing cable operators to make more efficient use of the available spectrum. DOCSIS 3.1 offers significantly higher speeds compared to its predecessors (up to 10 Gbps downstream and 1 Gbps upstream), making it a crucial upgrade for cable operators to meet these demands. The popularity of streaming platforms like Netflix, Hulu, and Amazon Prime Video requires significant bandwidth. DOCSIS 3.1's increased capacity allows cable operators to deliver these services smoothly without buffering or lag, enhancing user experience and potentially increasing customer satisfaction. This optimization helps increase overall network capacity and deliver higher data rates without requiring additional spectrum allocation.

CMTS and CCAP market in the Asia Pacific estimated to grow at the fastest rate during the forecast period.

The increasing population and urbanization in many countries within the Asia Pacific region contribute to a higher concentration of potential broadband subscribers, due to which this region has been experiencing a surge in demand for high-speed internet services due to the growing use of bandwidth-intensive applications, such as streaming, online gaming, and remote work. Moreover, Asia Pacific is also a major hub for consumer electronics, automotive, and industrial verticals. This region has become a global focal point for large investments and business expansions. Factors such as these are eventually driving the market for CMTS and CCAP.

Key Market Players

Major vendors in the CMTS and CCAP companies include CommScope (US), Cisco Systems, Inc. (US), Casa Systems (US), Harmonic Inc. (US), Nokia (Finland), Huawei Technologies Co., Ltd. (China), Broadcom (US), Juniper Networks, Inc. (US), Jinghong V & T technology Co., Ltd. (China), and Sumavision (China), among others.