In a world driven by digital transactions and financial innovation, the Nigeria Cards and Payments market stands as a testament to the nation's evolving economic landscape. From a historical perspective to the current digital transformation, this article delves into the intricacies of Nigeria's cards and payments sector, exploring its challenges, opportunities, and future outlook.

Introduction to Nigeria Cards and Payments Market

The Nigeria Cards and Payments market play a pivotal role in the country's economic narrative. As we navigate through this article, we'll unravel the historical evolution, assess the current landscape, and project the future of this dynamic sector.

Historical Perspective

The journey of cards and payments in Nigeria is a fascinating tale of adaptation and innovation. From the introduction of the first debit card to the establishment of a robust payment infrastructure, the sector has undergone significant milestones.

Current Landscape

Presently, the Nigeria Cards and Payments market is a bustling arena with various players contributing to its vitality. Established financial institutions, fintech startups, and global payment giants all play integral roles in shaping the sector.

Types of Cards in Nigeria

Debit cards, credit cards, and prepaid cards form the backbone of the nation's payment ecosystem. Each type serves a distinct purpose, catering to the diverse financial needs of the population.

Digital Transformation

Technology has been a driving force behind the transformation of the cards and payments landscape in Nigeria. The widespread adoption of digital wallets and mobile payments reflects the changing preferences of consumers.

Regulatory Framework

A robust regulatory framework is essential for maintaining the integrity of the market. Regulatory bodies in Nigeria ensure compliance and establish guidelines to foster a secure and transparent financial environment.

Challenges and Opportunities

While challenges such as cybersecurity threats and regulatory compliance persist, the Nigeria Cards and Payments market presents numerous opportunities for growth and innovation. Understanding and navigating these dynamics are key to success.

Consumer Behavior Trends

The way consumers interact with financial services is constantly evolving. Understanding the factors influencing consumer behavior is crucial for stakeholders in the cards and payments market.

Security Measures

As technology advances, so do security measures. This section explores the current measures in place and predicts future trends in payment security.

Financial Inclusion Initiatives

Efforts to include the unbanked population have been a focal point of the industry. The impact of these initiatives goes beyond financial services, contributing to the overall economic development of the nation.

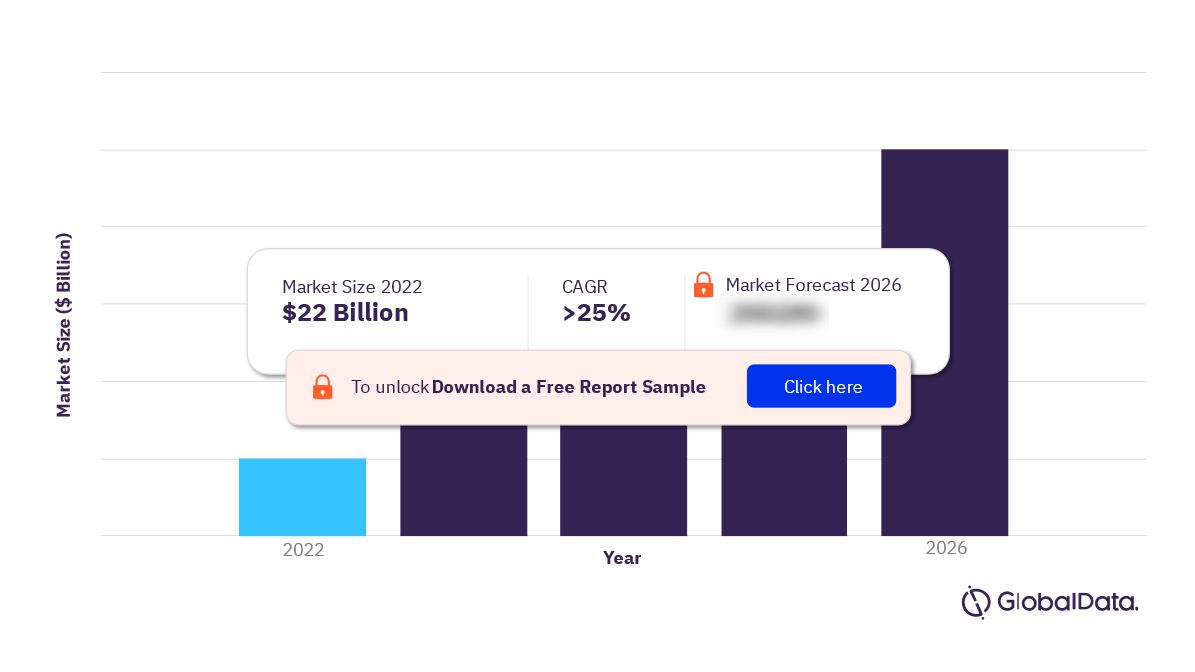

Key Market Statistics

Data-driven insights provide a comprehensive understanding of the market's growth projections and current trends. Analyzing these statistics is vital for making informed decisions.

Global Comparisons

Comparing Nigeria's cards and payments market with other countries offers valuable insights. Lessons learned from global counterparts can guide the industry toward continuous improvement.

Future Outlook

Predicting the future of the Nigeria Cards and Payments market involves assessing emerging technologies and understanding their potential impact. This section explores the trends that are likely to shape the sector in the years to come.

Case Studies

Real-world examples, both successes and failures, provide practical lessons for stakeholders. Case studies offer a nuanced view of the challenges and triumphs within the market.

Conclusion

In conclusion, the Nigeria Cards and Payments market is a dynamic and evolving sector with a rich history and a promising future. Navigating the financial landscape requires a keen understanding of the market's complexities, coupled with a commitment to innovation and consumer-centric solutions.

To gain more information on the Nigeria cards and payments market forecast, download a free report sample