The wealth management market in India has been growing steadily in recent years, driven by factors such as a rising affluent population, increasing disposable income, and a growing awareness of financial planning and investment opportunities. Let's delve into the market sizing and opportunities in the Indian wealth management sector.

Market Sizing: The exact size of the wealth management market in India can vary based on different sources and methodologies. However, it is widely acknowledged that the market is substantial and has significant growth potential. According to various estimates, the total assets under management (AUM) of the Indian wealth management industry were around INR 30-35 trillion (USD 400-470 billion) as of 2020. This figure includes both individual and institutional wealth managed by wealth management firms, banks, and other financial institutions.

Opportunities:

-

Growing Affluent Population: India's middle class and affluent population have been expanding rapidly, leading to an increase in the number of individuals seeking professional wealth management services. This presents a significant opportunity for wealth management firms to cater to the financial needs of these individuals and help them grow and preserve their wealth.

-

Increasing Financial Literacy: As financial literacy improves across the country, more individuals are becoming aware of the importance of financial planning and seeking professional guidance. Wealth management firms can tap into this opportunity by offering comprehensive financial planning services, investment advice, and customized wealth management solutions.

-

Digital Transformation: The rise of digital technology has revolutionized the wealth management industry, opening up new avenues for growth and enhancing customer experience. Firms that leverage digital platforms and tools to provide convenient and personalized services have a competitive advantage in the market. Embracing technological advancements such as robo-advisory platforms, mobile apps, and online portfolio management tools can help wealth management companies reach a wider customer base and enhance operational efficiency.

-

Product Innovation: Wealth management firms can differentiate themselves by introducing innovative products and services tailored to the unique needs and preferences of Indian investors. This includes offering investment options that align with sustainable and responsible investing, as environmental, social, and governance (ESG) considerations are gaining prominence in the investment landscape.

-

Expansion in Tier 2 and Tier 3 Cities: While wealth management services are more prevalent in major cities, there is a significant untapped market in Tier 2 and Tier 3 cities. As the economic prosperity spreads beyond metropolitan areas, wealth management firms can capitalize on the growing wealth and investment potential in these regions by establishing a presence and offering localized services.

-

Pension and Retirement Planning: India's demographic shift towards an aging population presents an opportunity for wealth management firms to cater to the retirement and pension planning needs of individuals. Providing comprehensive retirement solutions, including pension funds, annuities, and post-retirement income strategies, can be a lucrative area for growth.

-

Strategic Partnerships and Collaborations: Wealth management firms can explore strategic partnerships with banks, insurance companies, and other financial institutions to expand their reach and offer integrated solutions. Collaborating with fintech startups can also facilitate innovation and help firms stay at the forefront of technological advancements.

It is important to note that the wealth management landscape in India is highly competitive, with both domestic and international players vying for market share. To succeed, firms need to prioritize client-centricity, deliver value-added services, maintain regulatory compliance, and continuously adapt to changing customer preferences and market dynamics.

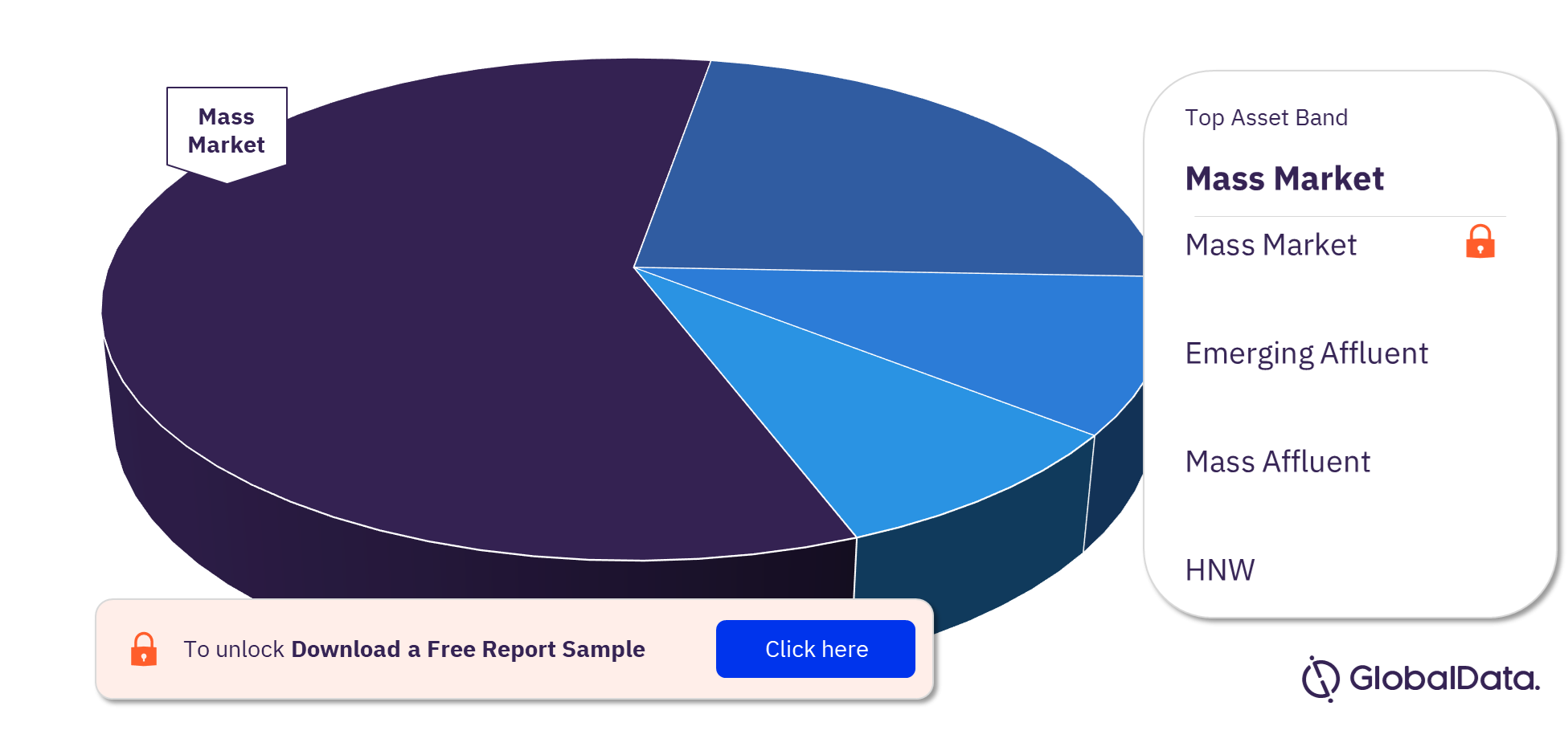

For more asset bands insights into the India wealth management market, download a free report sample