US and European e-merchants are keen to enter the fast-growing Latin American e-commerce market. But they need to be able to accept a multiplicity of online payment methods and cope with complex local tax regulations. Robin Arnfield reports.

According to an AméricaEconomía Intelligence study commissioned by Visa, the Latin American and Caribbean (LAC) B2C e-commerce market grew from $21.77bn in 2009 to $30.26bn in 2010 and $43.23bn in 2011. The Latin American consultancy predicts that the market will grow from an estimated $54.47bn in 2012 to $69.99bn in 2013.

AméricaEconomía says that in 2011 Brazil accounted for 59.1% of the LAC B2C e-commerce market, followed by Mexico with 14.2%, Argentina with 6.2%, and Chile with 3.5%. Central America and the Caribbean respectively accounted for 2.4% and 6.4% of the LAC B2C e-commerce market in 2011.

According to AméricaEconomía, 67.4% of the Argentine population had Internet access in 2011, giving Argentina the highest online penetration rate in Latin America. In Brazil, 43% of the population was connected to the Internet in 2011, with 47.3% using the Internet in Colombia, and 29.4% in Mexico.

A February 2012 online shopper survey by UK-based payment processor WorldPay found that 38% of Argentinians shopped on foreign websites in 2011, compared to 43% of Brazilians and 50% of Mexicans.

Latin America’s e-commerce market is attracting the attention of large US and European e-merchants. The Brazilian e-commerce market, which is growing at 25% a year according to Marcelo Theodoro, Latin American product and marketing director at e-payments processor PayU Latam, is particularly attractive to foreign entrants. Recent arrivals include Apple’s Brazilian iTunes Store which opened in December 2011, and Amazon, which entered the Brazilian market in December 2012. AméricaEconomía’s 2012 Latin American e-commerce market study quotes Neil Ashe, president of Walmart Global E-Commerce, as saying that "Brazil is Walmart.com’s second priority after China."

"US e-commerce companies using MercadoPago’s Latin American online payments gateway include Walmart, Hewlett-Packard, Facebook, and Groupon," says Mariano Garrasino, MercadoPago’s head of sales, business development and marketing. MercadoPago is the online payments arm of Nasdaq-quoted MercadoLibre, which owns online marketplaces across Latin America.

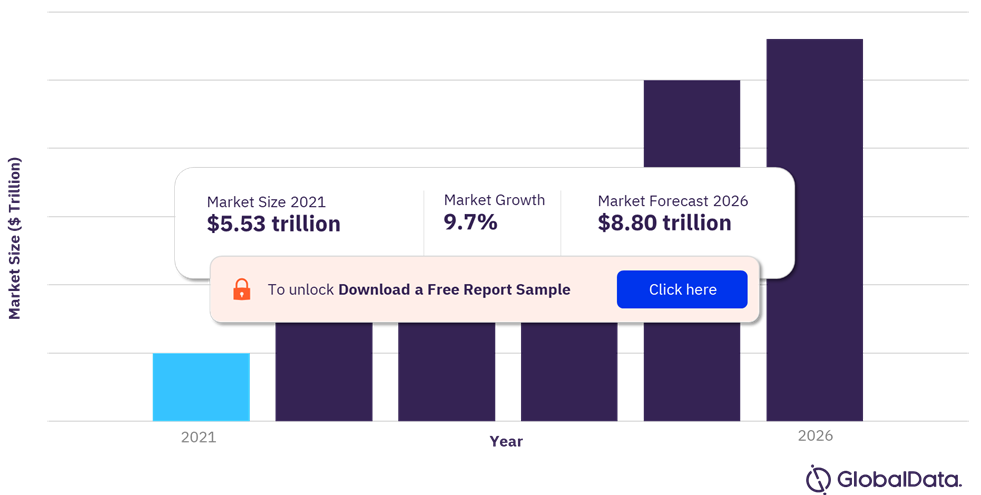

View Sample Report for Additional Insights on the B2C E-Commerce Market Size Projections, Download a Free Report Sample